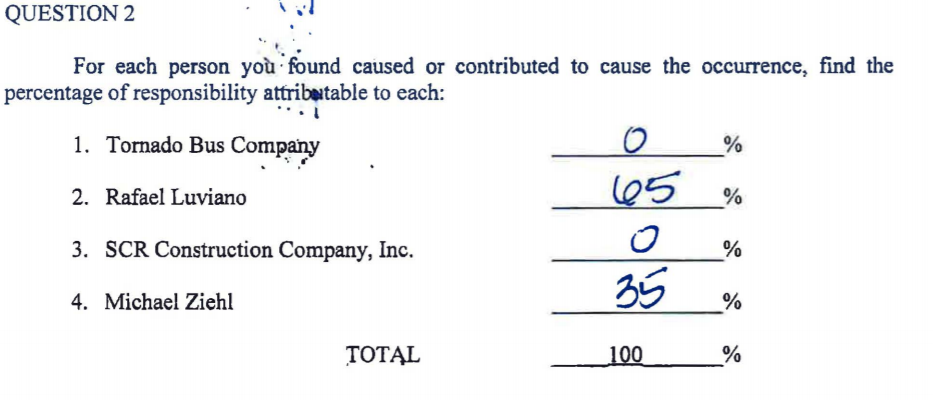

A valet service damaged the plaintiff’s 2018 Lamborghini Huracan (a 2017-model example of which appears in the graphic). The Fifth Court affirmed a small award for loss of use, noting the trial court’s consideration of evidence about other vehicles available to the plaintiff and the effects of the COVID-19 pandemic. It rejected the plaintff’s request for damages for dimunition of value, noting:

A valet service damaged the plaintiff’s 2018 Lamborghini Huracan (a 2017-model example of which appears in the graphic). The Fifth Court affirmed a small award for loss of use, noting the trial court’s consideration of evidence about other vehicles available to the plaintiff and the effects of the COVID-19 pandemic. It rejected the plaintff’s request for damages for dimunition of value, noting:

Jones failed to provide any factual basis on which his valuation opinions rested. While Jones testified about how much he paid for the car seven months before the accident, he provided no factual basis to support his speculation about the value of the car at the time of the accident or after it was repaired. The basis for Jones’s opinions were conversations with people who sell “these cars” and “internet sites for all those cars out there.”

Jones v. Mr. Valet, No. 05-23-00355-CV (March 20, 2024) (mem. op.).

(This is a crosspost from

(This is a crosspost from