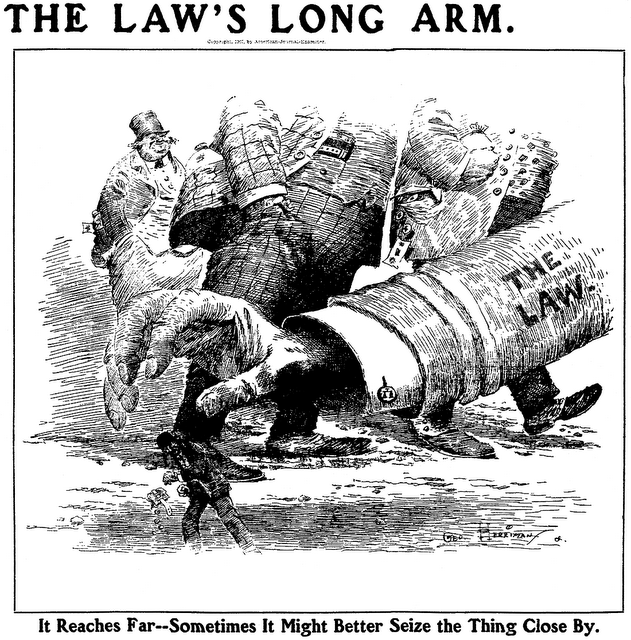

The Fifteenth Court’s recent opinion in State of Texas v. Yelp is a good summary of Texas personal-jurisdiction law about online activity.

The Fifteenth Court’s recent opinion in State of Texas v. Yelp is a good summary of Texas personal-jurisdiction law about online activity.

Texas sued Yelp under the DTPA, alleging that Yelp appended a “Consumer Notice” to the business pages of crisis pregnancy centers, including more than 200 in Texas, that misled Texas consumers. Yelp specially appeared.

The Court found that Texas did not adequately plead general jurisdiction. Raising a theory of “consent by registration” in response to the special appearance did not qualify as raising the issue in a pleading, as required in this procedural context.

While the Court did not reach the issue, it showed skepticism toward reading Texas’s registration statutes as conferring consent to general jurisdiction.

- After the Supreme Court’s 2023 Mallory opinion, Texas intermediate appellate courts have held that, unlike the Pennsylvania statute in that case, Texas’s business-registration framework does not expressly condition registration on consent to all-purpose jurisdiction (either in the long-arm statute or the registration statutes).

- Section 9.203 of the Business Organizations Code, cited by some plaintiffs in this regard, has been read to equalize “duties, restrictions, penalties, and liabilities” of foreign and domestic entities in matters affecting intrastate business – not to transform registration into blanket consent to suit.

Texas did establish specific jurisdiction, concluding that:

- Purposeful availment requires conduct that is … purposeful: not random or fortuitous, and designed to secure benefits in the forum. state Yelp’s location-specific curation, ad sales, and Texas market cultivation fit the bill.

- “Relatedness” does not demand a strict causal chain. It is enough that the suit “arises out of or relates to” the Texas-directed conduct. The Texas-focused placement of the Consumer Notice and its alleged effects on Texas consumers satisfied that standard.

- Nationwide conduct does not defeat forum relatedness. A defendant need not uniquely single out Texas if it deliberately includes Texas in its targeted markets.

- Internet presence alone is insufficient, but internet targeting matters. The Court distinguished cases about general news content, accessible in Texas, from conduct aimed at Texans seeking services in Texas.

No. 15-24-00040-CV (Oct. 16, 2025).