Megatel Homes v, Martin, in the context of a dispute about arbitration of a contract to build a home, provides a succinct explanation of contract formation and its legal significance:

Megatel Homes v, Martin, in the context of a dispute about arbitration of a contract to build a home, provides a succinct explanation of contract formation and its legal significance:

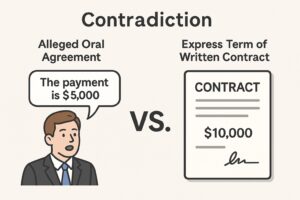

The parties’ conduct objectively manifested an agreement on the subject matter and the essential terms of the contract—Megatel would build a house at a specific address for the Martins in exchange for the Sales Price. Thus, we conclude that the parties entered into a contract that defined their respective rights. Both the June Document and July Document include the same arbitration clause that Megatel seeks to enforce, and to which the parties agreed. … Although the Martins maintain that they would not have entered into the contract if they had known about the alleged misrepresentations made by Megatel, those complaints go to the merits of the lawsuit rather than whether a contract was formed. The terms of that contract, based on the undisputed conduct of the parties, necessarily include the arbitration provision even though it may not include the list of Special Features—a matter we do not reach today.

No. 05-25-00030-CV (Oct. 24, 2025) (emphasis added).

(This is a crosspost from

(This is a crosspost from

erative fact, a necessary part of a cause of action, and is not hearsay.”

erative fact, a necessary part of a cause of action, and is not hearsay.”